JAN AAS TIMES | New Delhi

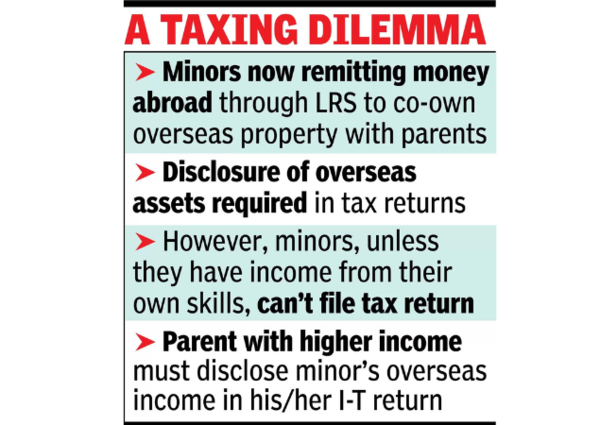

MUMBAI: Indians were persistently a few of the most sensible patrons of marquee houses in a foreign country whether or not it’s in sunny California, tony portions of Dubai like Emirates Hills and Palm Jumeirah or mansions in London’s Mayfair. Now, even minors are making an investment in in a foreign country houses at the side of their folks, with UAE being a favoured vacation spot. To try this, minors are remitting cash in a foreign country below the RBI’s Liberalised Remittance Scheme (LRS).

In view of greater scrutiny on in a foreign country investments, and stringent consequences below the Black Cash Act for non-disclosure, top web price folks (HNIs) are turning to professionals for recommendation.

LRS norms limit folks from remitting greater than $250,000 in step with monetary yr for quite a lot of functions, together with purchasing belongings. As in step with an modification efficient August 24, 2022, unused budget will have to be returned to India if no longer invested inside 180 days.

Up to now, folks may acquire budget in overseas financial institution accounts to pool sufficient for a belongings acquire, equivalent to a $1 million flat in Dubai. The 180-day restrict now makes this difficult, and a few favor keeping off the complexities of in a foreign country fairness funding.

Minors are thus used to verify sufficient budget are remitted for an outright belongings acquire. Gautam Nayak, tax spouse at CNK & Pals, notes, “Price range may also be remitted in another country via a minor below LRS, the usage of presents from folks in India. Additional, presents from folks to youngsters would not have any tax affect in India.”

If a pair and their two minor youngsters remit cash to shop for belongings in Dubai, Anil Harish, recommend and spouse at DM Harish & Co, advises that the valuables must be in all 4 names, together with the minors. Dubai actual property professionals ascertain that minors can personal belongings via a mother or father or trustee, without a regulatory affect from India’s standpoint. Harish additionally notes that each Indian tax resident with in a foreign country property will have to document an income-tax go back (ITR) and divulge those property, together with belongings, in Agenda FA (overseas property). Any overseas revenue will have to be reported in Agenda FSI (overseas supply revenue).

If right kind disclosure isn’t made within the ITR, a penalty of Rs 10 lakh is chargeable below the Black Cash Act. A Mumbai tax tribunal’s choice has set a precedent on this regard.

“In case an in a foreign country belongings is fetching revenue – say, condo revenue – it’s going to be clubbed within the fingers of the guardian who has the upper revenue. A ‘beneficiary’ of an in a foreign country asset the place the revenue is clubbed with some other person does no longer need to document an I-T go back. An exclusion is to be had below the 5th proviso to phase 139(1),” stated Rutvik Sanghvi, spouse, Rashmin Sanghvi & Pals.

Then again, the problem can get somewhat complicated. “If a minor is without doubt one of the co-owners of a Dubai belongings, he/she isn’t simply a beneficiary. Whilst I-T rules supply for clubbing of revenue, they don’t supply for clubbing of property for disclosure functions. The topic is compounded because the tax submitting platform does no longer allow a minor to document a go back, except he/she has earned revenue via his personal efforts (say, as a kid actor),” added Sanghvi.

Nayak expands in this quandary. “A minor’s tax go back must be filed via a guardian as a mother or father, who has to check in at the income-tax portal throughout the minor’s account. Such registration isn’t being allowed except evidence of the minor having revenue via minor’s efforts or ability is filed on-line. Handiest then is the mother or father registered, and a minor can document a tax go back.”

Up to now, minors have, and proceed to, obtain tax notices according to knowledge shared via overseas international locations. I-T officers, with whom TOI spoke, referenced the case of 1 Nirmal Jain by which the tax tribunal upheld a penalty of Rs 10 lakh for every of 3 disputed years. Even though Jain reported his minor youngsters’s in a foreign country revenue (pastime from an in a foreign country fund) as his personal below the clubbing provisions of the I-T Act, he didn’t divulge their property in Agenda FA in his ITR.

Whilst Jain had argued that no black cash was once all for making the in a foreign country funding, the appellate tribunal held that the penalty below the Black Cash Act was once for non-reporting of in a foreign country property and no longer for making investments from unaccounted cash. Tax professionals advise that the mother or father managing the minor’s property in UAE, as an example, must divulge the overseas asset of their tax go back. Given the instances, I-T officers agree that is essentially the most sensible method.